Volunteer Stipends, Interns, and Employee Volunteers: Some Important Things to Know

As your organization brings volunteers back to work, you might be tempted to offer volunteer stipends to sweeten the pot.

While, at first glance, that might seem like an admirable idea, it may cause extra trouble for volunteers and your organizations further on down the line.

This guide will help you determine what’s legal and the unintended consequences for everyone.

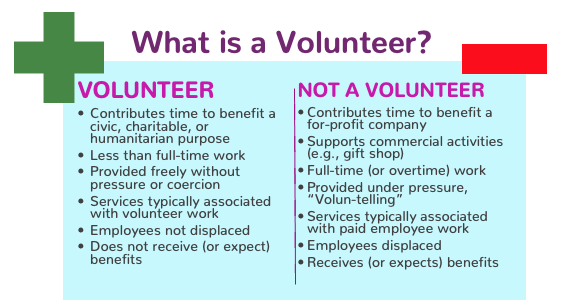

What is a “Volunteer”?

I often speak with programs that are interested in offering cash “perks” or stipends to volunteers or want to encourage employees to help out after work in order to build their volunteer capacity. If you’re thinking about offering volunteer stipends or recruiting employees to volunteer, be sure you understand how labor laws might affect you. Below is a brief run-down.

According to the US Department of Labor, volunteers are individuals who perform hours of service for religious, charitable, or similar non-profit organizations without promise, expectation, or receipt of compensation (note: if you live outside the US, check your country’s labor laws). In addition, all of the following must also be true:

- The entity that benefits from the service is a nonprofit (or government agency)

- The activity is less than full time

- The services are not offered as a result of coercion

- The services are typically associated with volunteer work

- No regular employees have been displaced by the volunteer

- The volunteer does not expect to be compensated

It’s important to understand this definition of a volunteer because it affects what protections a worker, paid or unpaid, is entitled to.

In the United States, true “volunteers,” as defined by law, are not considered employees and, therefore, are not covered by the US Fair Labor Standards Act. Similarly, paid employees, as defined by law, are not protected by the federal Volunteer Protection Act.

For more detail, check out the actual language in the Federal Volunteer Protection Act.

Trainees

Trainees, such as school-to-work or internship program participants, may also be considered volunteers versus employees; however, the same rules apply as far as stipends go. In order to be considered a “trainee”, the following must also be true:

- The training, even though it includes actual operation of the facilities of the employer, is similar to that which would be given in a vocational school;

- The training is for the benefit of the trainees or students;

- The trainees or students do not displace paid employees, but work under close supervision;

- The employer that provides the training receives no immediate advantage from the activities of the trainees or students and, on occasion, his operations may even be impeded;

- The trainees or students are not necessarily entitled to a job at the conclusion of the training period; and

- The employer and the trainees or students understand that the trainees or students are not entitled to wages for the time spent in training.

For more on the legal definition of an internship, check out — DOL Fact Sheet #71: Internship Programs Under The Fair Labor Standards Act

Public Sector Employees as Volunteers

If employees want to volunteer, there are also laws in place that are meant to protect them from exploitation, so be sure you know the parameters.

Public sector employees may volunteer for their agencies, but by law may not volunteer additional time to do the same work for which they are already paid. Whenever paid staff wish to volunteer their time for the agency for which they also work, they should be subject to the same formal application process and supervision as other volunteers in the same role.

For more on how the law impacts nonprofit employment, check out — DOL Fact Sheet #14A: Non-Profit Organizations and the Fair Labor Standards Act (FLSA)

National Service Members

You may also be wondering how national service “stipends” fit into the picture.

Authorized and funded by Congress, the newly rebranded federal agency AmeriCorps (formerly the Corporation for National & Community Service (CNCS), in partnership with the State Service Commissions, operates the following national service programs:

- AmeriCorps

- AmeriCorps NCCC (National Civilian Conservation Corps)

- AmeriCorps VISTA (Volunteers In Service To America)

- AmeriCorps Seniors

- AmeriCorps Seniors includes Foster Grandparents, Senior Companions, and RSVP (Retired and Senior Volunteer Program). FEMA Corps is a program of AmeriCorps NCCC.

AmeriCorps members receive a living allowance to cover expenses and some AmeriCorps Seniors receive a stipend.

Education awards are also made to members who complete certain requirements.

While a stipend is not a salary, it is still considered to be taxable income by the U.S. government. People who receive a stipend are not expected to pay Medicare taxes or Social Security, but they do need to set a certain amount of money aside to pay the taxes they owe.

Education awards can be used to repay qualified student loans or future tuition, which some schools will match. Loan deferment and interest forbearance are also available.

To Offer Volunteer Stipends: A Thorny Issue

Now, that you understand the differing types of people who might contribute time and talent to your organization, we can then better understand how stipends might impact the situation.

Offering “just a little something” to volunteers can get tricky. By doing so, you may inadvertently convert your “volunteer” into an “employee” and thus crate tax liability on their part. So, it is vital that you understand when and how this might happen.

Below are some guidelines, but I also recommend that you speak with your account to be completely sure you understand the implications and how it may shift how you report wages to the IRS and your state.

This decision may also impact whether or not you need to purchase worker’s compensation for your stipended volunteers. So, now is an excellent time to speak to your insurance broker, as well.

According to the Department of Labor, if a volunteer is paid a stipend of over $500 a year or 20% more than what an employee would be paid, they must be treated as paid staff and are subject to the laws that govern employees.

For more context, check out this US Department of Labor Opinion on Stipends.

If you decide to offer stipends, be sure you have the proper accounting system in place. Volunteers who receive stipends must be treated the same as paid staff, and payroll tax contributions must be withheld from their pay. This goes for in-kind benefits as well, which must be assigned a fair market value.

Reimbursements for expenses incurred while volunteering are also sometimes considered taxable income. In addition to knowing the rules on your end, it’s also important for volunteers to check with their own accountants or tax preparers about the possibility of deductible expenses. Volunteer mileage, for example, is deductible, but not at the same rate as mileage for business.

As a general rule, the following is considered non-taxable income, if they are occasional or infrequent, not routine:

- Personal use of photocopier (no more than 15% of total use)

- Group meals, employee picnics

- Theater or sporting event tickets

- Occasional coffee, doughnuts or soft drinks

- Flowers or fruit for special circumstances

- Local telephone calls

- Traditional birthday or holiday gifts (not cash) with a low fair market value

- Commuting use of employer’s car if no more than once per month

- Employer-provided local transportation

- Personal use of cell phone provided by an employer primarily for a business purpose

The following is considered taxable income:

- Cash – except for infrequent meal money to allow overtime work

- Cash equivalent (for example, savings bond, gift certificates, gift cards)

- Certain transportation passes or costs

- Use of employer’s apartment, vacation home, boat

- Commuting use of employer’s vehicle more than once a month

- Membership in a country club or athletic facility

- Any item that exceeds a value of $100

In addition, reimbursable payments to volunteers or employees based on documented allowable expenditures do not constitute income and, therefore, are not taxable.

In these cases, the organization is required to maintain records related to the reimbursement, including any backup documentation. So, make sure you both know what is taxable and keep good records.

Finally, volunteer recognition gifts of limited value, are sometimes considered a “de minimus benefit” and are not taxed. But this only applies up to certain levels.

For more on what can be deducted from taxes (and what cannot), check out the IRS Publication 526: Charitable Contributions. Be sure to reference the most up-to-date version for your tex year.

If you decide to offer stipends to volunteers, keep the following in mind:

- Never pay more than a nominal 20% of what an employer would otherwise pay for the same service.

- Do not offer benefits that other employees received.

- Make it clear if a volunteer receives more than $500 a year in compensation, they will no longer be protected from liability claims by the Federal Volunteer Protection Act.

- Check with your accountant to determine whether any volunteer gifts you have planned, including gift cards, are taxable.

For creative ideas for recognizing volunteers, check out our post New and Exciting Ideas for Volunteer Rewards and Recognition.

Your Due Diligence

To prevent misunderstandings, it is important for volunteers and staff alike to clearly delineate the difference between volunteer and staff duties.

Developing distinct position descriptions, volunteer agreements, and program policies and procedures for the volunteer program can help decrease the chance of misunderstandings, and thus, the risk to the organization.

Also, be sure that any paid staff who also wish to volunteer their time are treated the same as other volunteers and agree on tasks that are different than their paid work.

Finally, make sure that you and volunteers have clear boundaries for when they are officially appointed and when they are officially on, and off, the clock. This will be helpful in determining liability and protections in the event of a mishap during service.

When it comes to offering volunteer stipends and other perks, clarity is essential. So, take time to fully understand before you make the offer to pay just a little something for their time.

Level Up Your Volunteer Engagement with Our Free Guide

Are you a nonprofit or public sector organization looking for inspirational guidance on how to lead volunteers with purpose? Then, look no further.

Our VolunteerPro Essential Guide to Managing Volunteers in Your Nonprofit will help you get started off on the right foot. Whether you are brand new to volunteer coordination or have been at for years, we hope you’ll find some helpful advice and resources on these pages.

Managing volunteers needn’t be a source of frustration. With a little investment of time and attention, your nonprofit can generate powerful volunteer impact that expands your base of donors and supporters and strengthens connections with diverse communities far beyond your agency’s doors.

The statement that “Reimbursements for expenses incurred while volunteering are also, surprisingly, considered taxable income.” is not entirely correct.

Check with your accountant for specific application to your organization, but generally payments to volunteers or employees based on documented allowable expenditures (accountable plan) would not constitute income. The organization is required to maintain records related to the reimbursement, including any backup documentation.

Thank you for the additional information, Teresa.

It’s also important for volunteers to check with their own accountants or tax preparers about the possibility of deductible expenses. Volunteer mileage, for example, is deductible, but not at the same rate as mileage for business. Here’s a link to info from the IRS on this topics — http://www.irs.gov/pub/irs-pdf/p526.pdf